You should consider these important points before you move your assets to a new financial adviser. There could be small termination charges for moving your money. A good idea is to have hard copies for important financial documents. These include your cost basis, which will be used to calculate all taxable investments. You should also know how to get a signature on any paperwork that you sign. Here are some tips for getting started.

Transfer assets to a different financial advisor

After making the decision to move financial advisers you should transfer your assets. Transferring your assets to a new adviser will usually take around a week. When you're changing advisors, it is important that you have all of your financial documentation ready to hand. These documents are often available online or over the phone by many advisors. You should notify your adviser about any changes in life. Make sure to tell them how often and what you would like to communicate with your adviser. If you prefer to avoid this confrontation, it may be worth requesting the transfer documents in hard copy.

Finding a new advisor in financial services

When looking for a new financial advisor, you should consider the following simple steps. Learn as much about the advisor's experience and background as possible. Determine if the advisor is available to meet your needs in person or online. Second, make an appointment to meet with them face-to–face. You can determine whether they are trustworthy, affordable, and communicative. Third, you should ask questions. Aside from the advisor's background, you should know what kind of services he or she offers to his or her clients.

Costs involved in changing financial advisors

While there may be some fees associated with changing your financial advisor, there are also benefits. It may help you to avoid paying high fees if you change advisors. Selling your retirement assets may allow you to avoid paying taxes. Be sure to weigh the pros and con's of each advisor before making the move. The pros outweigh the cons. Here are some great ways to save cash by changing your financial adviser:

Requiring a signature

You may be wondering how to change your financial advisor without signing a contract. You can change your AFPS fee without signing a contract, but your advisor must obtain your written authorization before the changes take effect. An advisor can help open an account or manage it. However, changes to elections that you have made will require your signature.

Find out if your financial advisor has been designated as a fiduciary

Before you hire your financial advisor, make sure to verify that they are operating under the fiduciary Standard. You can be sure that your advisor is dedicated to helping you reach your financial goals, not their financial gain. The fiduciary model has many advantages over other financial advisors. Ask your prospective advisor about this.

Preparing for the Switch

Transferring your accounts will take a few days or weeks. Discuss tax implications and gather all relevant documentation. Also, make sure the new advisor can hold your accounts legally. Some advisors can't hold certain kinds of assets, so make sure the new advisor is aware of these circumstances. You will need to keep in touch with your advisor after the transfer is completed to ensure smooth transition.

FAQ

How to Start Your Search for a Wealth Management Service

You should look for a service that can manage wealth.

-

Proven track record

-

Is the company based locally

-

Offers complimentary initial consultations

-

Provides ongoing support

-

Has a clear fee structure

-

A good reputation

-

It is easy to contact

-

You can contact us 24/7

-

Offers a wide range of products

-

Low fees

-

Hidden fees not charged

-

Doesn't require large upfront deposits

-

Make sure you have a clear plan in place for your finances

-

You have a transparent approach when managing your money

-

It makes it simple to ask questions

-

Has a strong understanding of your current situation

-

Learn about your goals and targets

-

Are you open to working with you frequently?

-

Works within your budget

-

Has a good understanding of the local market

-

Are you willing to give advice about how to improve your portfolio?

-

Is willing to help you set realistic expectations

What is wealth administration?

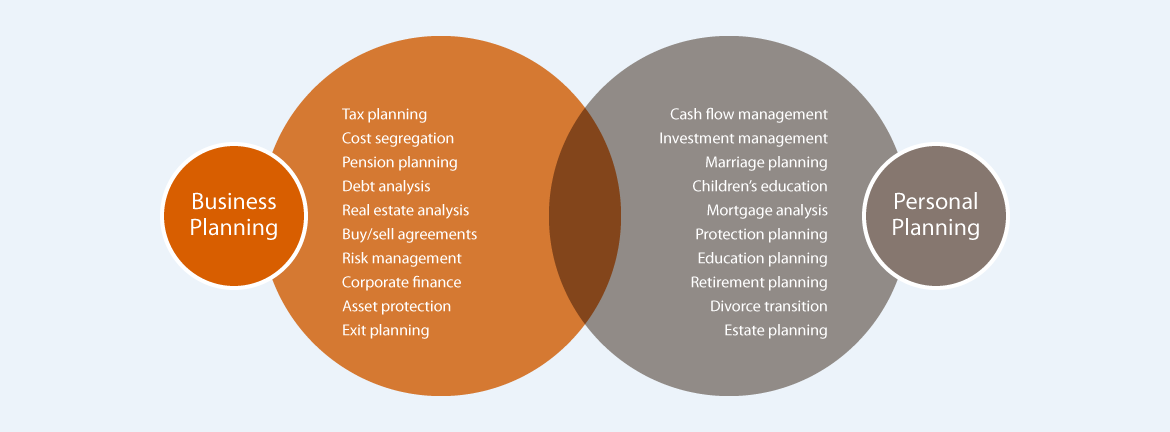

Wealth Management is the art of managing money for individuals and families. It covers all aspects related to financial planning including insurance, taxes, estate planning and retirement planning.

What is a Financial Planner? How can they help with wealth management?

A financial planner will help you develop a financial plan. They can look at your current situation, identify areas of weakness, and suggest ways to improve your finances.

Financial planners can help you make a sound financial plan. They can assist you in determining how much you need to save each week, which investments offer the highest returns, as well as whether it makes sense for you to borrow against your house equity.

A fee is usually charged for financial planners based on the advice they give. However, there are some planners who offer free services to clients who meet specific criteria.

What are the Benefits of a Financial Advisor?

A financial plan is a way to know what your next steps are. It will be clear and easy to see where you are going.

It provides peace of mind by knowing that there is a plan in case something unexpected happens.

A financial plan can help you better manage your debt. A good understanding of your debts will help you know how much you owe, and what you can afford.

A financial plan can also protect your assets against being taken.

What is Estate Planning?

Estate Planning refers to the preparation for death through creating an estate plan. This plan includes documents such wills trusts powers of attorney, powers of attorney and health care directives. The purpose of these documents is to ensure that you have control over your assets after you are gone.

Statistics

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to become Wealth Advisor

You can build your career as a wealth advisor if you are interested in investing and financial services. There are many opportunities for this profession today. It also requires a lot knowledge and skills. These skills are essential to secure a job. A wealth advisor's main job is to give advice to investors and help them make informed decisions.

To start working as a wealth adviser, you must first choose the right training course. It should cover subjects such as personal finances, tax law, investments and legal aspects of investment management. And after completing the course successfully, you can apply for a license to work as a wealth adviser.

These are some ways to be a wealth advisor.

-

First, learn what a wealth manager does.

-

All laws governing the securities market should be understood.

-

Learn the basics about accounting and taxes.

-

After completing your education, you will need to pass exams and take practice test.

-

Finally, you will need to register on the official site of the state where your residence is located.

-

Apply for a license for work.

-

Give clients a business card.

-

Start working!

Wealth advisors often earn between $40k-60k per annum.

The size and geographic location of the firm affects the salary. So, if you want to increase your income, you should find the best firm according to your qualifications and experience.

We can conclude that wealth advisors play a significant role in the economy. It is important that everyone knows their rights. It is also important to know how they can protect themselves from fraud or other illegal activities.