Complete specific training to become a financial adviser. These professionals often need to register with a regulatory agency. The job description is as varied as the number of different types of financial advisers. We will be discussing the educational requirements and the certifications you could earn to become a certified financial advisor. Once you've achieved your certification, your career can begin! But how do I become one?

Financial advisors have a bright future.

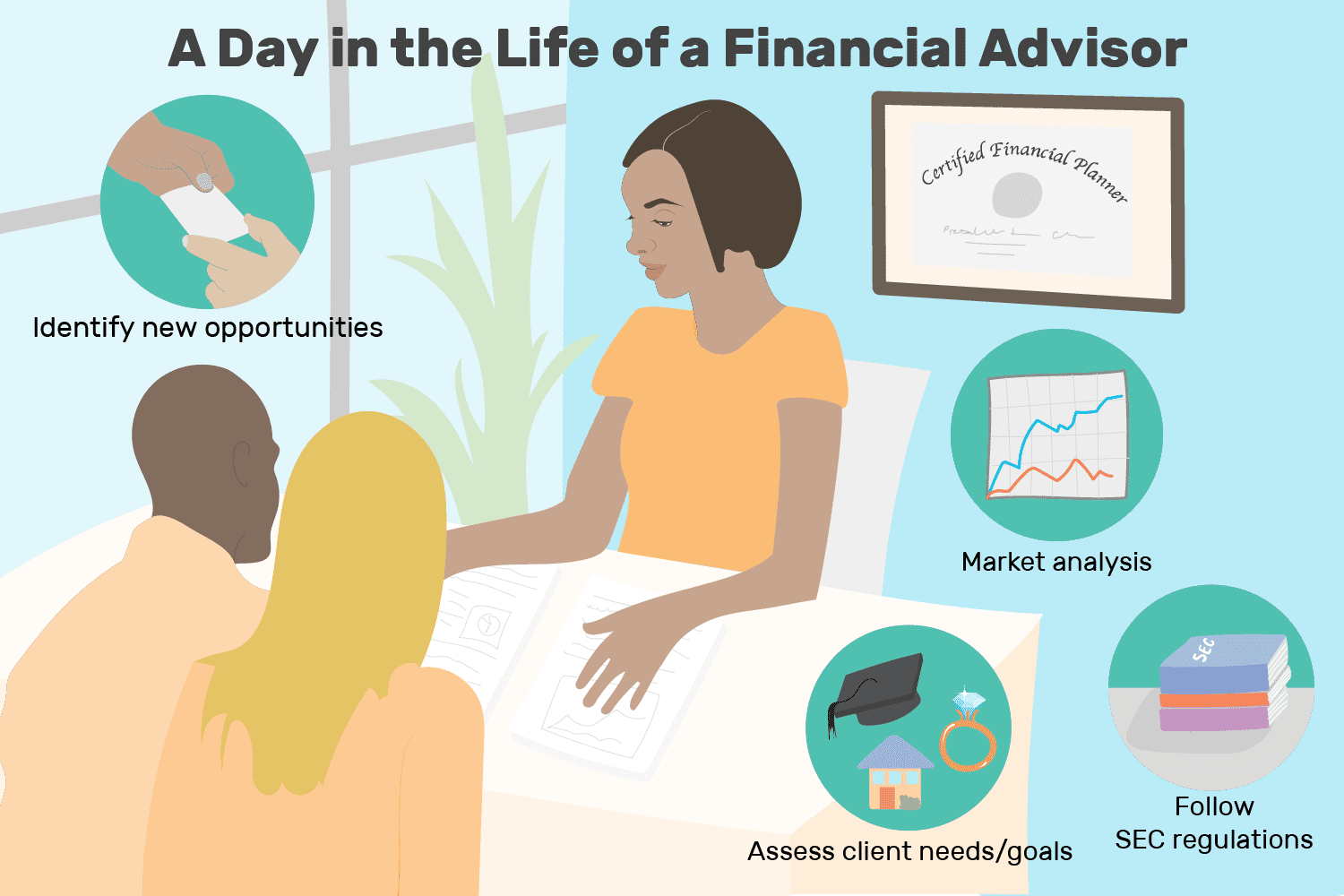

A financial advisor is a professional that offers advice to clients about a range of financial topics. This job requires specialized training and registration with an regulatory body. There are many types of advisors, and there is a good job outlook for them. Financial advice can be both rewarding and lucrative. This is how this career path looks. Your future prospects are in your own hands.

To become a financial advisor, you will need a bachelor's degree in an appropriate field, such as mathematics, finance, accounting, statistics, or business administration. Some advanced jobs require you to earn a master's degree, and you may want to specialize in certain areas, like business administration or finance. Financial advisors have a varied salary, so ensure you have the education necessary to succeed. Advisors often choose to earn advanced degrees like an MBA in financial administration or a Master’s degree in finance.

Education requirements

There are different education requirements depending on where you live. Some states require you to hold a degree and register as a member of the Securities and Exchange Commission to operate a financial planning firm. A Master of Financial Planning may be required depending on the state regulations. A Certified Financial Planner (CFP), can help you move up in your career and make a better salary.

For financial planners, a bachelor's degree must be obtained in a related subject. These include Math, Accounting, Business, Economics and Math. Also, you should aim to get an internship or a full-time position that will help you build your professional networks. An internship can give you invaluable experience, and it may lead to a job as a financial planner. You may still be able to get valuable experience working as a financial advisor even if your bachelor's degree is not required.

Certifications

You have many options to pursue a finance-specific degree. A bachelor's degree is sufficient. However, a master's will improve your financial knowledge and help you to succeed in your chosen field. A master's level in finance will complement your four-year education by giving you advanced study in financial analytics. CFP Board registered programs will teach how to make financial data gold.

In order to obtain the Certified Financial Planner (CFP) designation, candidates must have at least four years of relevant professional experience. This usually equals three years of full time work experience. While the CFP certification does not require a bachelor's degree, it can improve your chances of obtaining a lucrative job. Other credentials include Chartered Financial Analyst (CFA) and Chartered Financial Consultant (ChFC).

Compensation

Fee-only, commission-based and fee-based are the three most common types of compensation for financial advisers. Fee-based financial advisors receive a fixed monthly amount for their services. Fee-based advisors get a percentage of the investment assets managed. Commission-based advisors receive fees for selling specific products or performing financial transactions. Calamita Wealth Management charges an example of a percentage for assets under management.

Your compensation as an independent advisor can rise dramatically. FA Insight recently found that the average compensation for advisor firms with over $8M in annual revenue is 30% higher for lead advisors than that of service advisors. However, the difference between lead advisors and service advisors is minimal and is not evident when comparing the compensation for the two. As the financial advisory industry grows and formalizes its career paths, a standard progression for advisors is becoming clearer.

FAQ

What is risk management and investment management?

Risk management is the act of assessing and mitigating potential losses. It involves identifying, measuring, monitoring, and controlling risks.

Any investment strategy must incorporate risk management. Risk management has two goals: to minimize the risk of losing investments and maximize the return.

The following are key elements to risk management:

-

Identifying risk sources

-

Monitoring the risk and measuring it

-

How to control the risk

-

Managing the risk

How To Choose An Investment Advisor

It is very similar to choosing a financial advisor. There are two main factors you need to think about: experience and fees.

It refers the length of time the advisor has worked in the industry.

Fees represent the cost of the service. You should weigh these costs against the potential benefits.

It is important to find an advisor who can understand your situation and offer a package that fits you.

What is wealth management?

Wealth Management refers to the management of money for individuals, families and businesses. It includes all aspects regarding financial planning, such as investment, insurance tax, estate planning retirement planning and protection, liquidity management, and risk management.

Statistics

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to invest once you're retired

People retire with enough money to live comfortably and not work when they are done. But how do they put it to work? It is most common to place it in savings accounts. However, there are other options. You could also sell your house to make a profit and buy shares in companies you believe will grow in value. You can also get life insurance that you can leave to your grandchildren and children.

However, if you want to ensure your retirement funds lasts longer you should invest in property. If you invest in property now, you could see a great return on your money later. Property prices tend to go up over time. You could also consider buying gold coins, if inflation concerns you. They don’t lose value as other assets, so they are less likely fall in value when there is economic uncertainty.