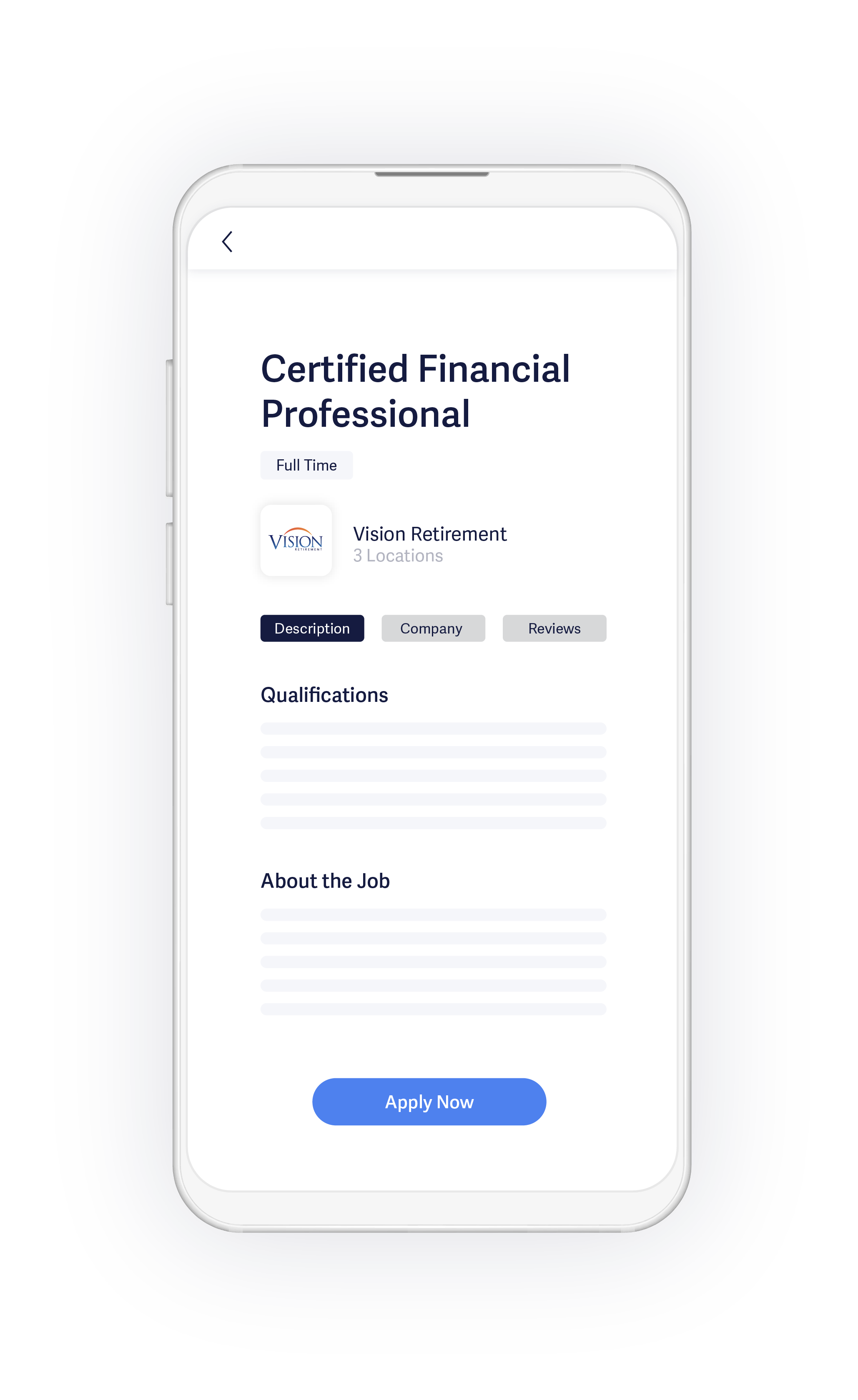

You should be able to verify the qualifications and experience of a financial advisor before you decide to hire him. A financial planner does more than just give recommendations. They will educate you about matters that affect your finances. While there are many types and styles of financial planners, you want to hire someone with extensive knowledge in the areas of economics, finance, and business. Because personal finance involves many intangibles and requires practical experience, you should look for someone who has this knowledge. It will be easier to find an advisor who has this experience.

It's like finding a new physician when you choose a financial advisor.

As a doctor, you will have many important relationships throughout your career. Many people will interact with you, such as patients, colleagues and family. Choosing a financial advisor is no different. A financial advisor should be able to understand your needs and goals. A fee-only financial planner may be the best option for you. Ask your potential advisor questions to find out more about their process and philosophy.

Financial advisors can be classified as a variety of services. Make sure you choose someone who is familiar with your goals and has a track-record. A person who is able to understand your concerns and needs without judgement is a good choice. An experienced financial advisor may have worked with physicians. Make sure to verify their credentials before you hire a financial advisor. You can also ask for a written guarantee.

It's like choosing a new physician

It can be difficult to choose a financial advisor. There are key things to remember when selecting a new adviser. Look for someone who can understand your financial situation. Your financial advisor should have the knowledge and experience to help you make sound financial choices today and into the future. Ideally, they should be flat-fee only.

FAQ

Why it is important to manage your wealth?

The first step toward financial freedom is to take control of your money. You must understand what you have, where it is going, and how much it costs.

Also, you need to assess how much money you have saved for retirement, paid off debts and built an emergency fund.

If you don't do this, then you may end up spending all your savings on unplanned expenses such as unexpected medical bills and car repairs.

How to Beat Inflation with Savings

Inflation refers to the increase in prices for goods and services caused by increases in demand and decreases of supply. Since the Industrial Revolution, people have been experiencing inflation. The government manages inflation by increasing interest rates and printing more currency (inflation). You don't need to save money to beat inflation.

Foreign markets, where inflation is less severe, are another option. The other option is to invest your money in precious metals. Two examples of "real investments" are gold and silver, whose prices rise regardless of the dollar's decline. Precious metals are also good for investors who are concerned about inflation.

What are the Different Types of Investments that Can Be Used to Build Wealth?

There are many different types of investments you can make to build wealth. Here are some examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its benefits and drawbacks. For example, stocks and bonds are easy to understand and manage. They can fluctuate in price over time and need active management. However, real estate tends be more stable than mutual funds and gold.

It's all about finding the right thing for you. It is important to determine your risk tolerance, your income requirements, as well as your investment objectives.

Once you have decided what asset type you want to invest in you can talk to a wealth manager or financial planner about how to make it happen.

What is risk management in investment management?

Risk management is the act of assessing and mitigating potential losses. It involves identifying and monitoring, monitoring, controlling, and reporting on risks.

A key part of any investment strategy is risk mitigation. Risk management has two goals: to minimize the risk of losing investments and maximize the return.

The key elements of risk management are;

-

Identifying sources of risk

-

Monitoring and measuring the risk

-

Controlling the risk

-

Manage your risk

How do I get started with Wealth Management?

It is important to choose the type of Wealth Management service that you desire before you can get started. There are many types of Wealth Management services out there, but most people fall into one of three categories:

-

Investment Advisory Services: These professionals can help you decide how much and where you should invest it. They can help you with asset allocation, portfolio building, and other investment strategies.

-

Financial Planning Services: This professional will work closely with you to develop a comprehensive financial plan. It will take into consideration your goals, objectives and personal circumstances. He or she may recommend certain investments based on their experience and expertise.

-

Estate Planning Services: An experienced lawyer will advise you on the best way to protect your loved ones and yourself from any potential problems that may arise after you die.

-

Ensure they are registered with FINRA (Financial Industry Regulatory Authority) before you hire a professional. You can find another person who is more comfortable working with them if they aren't.

Statistics

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

External Links

How To

How do you become a Wealth Advisor

A wealth advisor is a great way to start your own business in the area of financial services and investing. This job has many potential opportunities and requires many skills. These skills are essential to secure a job. A wealth advisor's main job is to give advice to investors and help them make informed decisions.

The right training course is essential to become a wealth advisor. It should include courses on personal finance, tax laws, investments, legal aspects and investment management. Once you've completed the course successfully, your license can be applied to become a wealth advisor.

Here are some tips on how to become a wealth advisor:

-

First, you must understand what a wealth adviser does.

-

You should learn all the laws concerning the securities market.

-

Learn the basics about accounting and taxes.

-

You should take practice exams after you have completed your education.

-

Finally, you must register at the official website in the state you live.

-

Apply for a licence to work.

-

Send clients your business card.

-

Start working!

Wealth advisors usually earn between $40k-$60k per year.

The location and size of the firm will impact the salary. Therefore, you need to choose the best firm based upon your experience and qualifications to increase your earning potential.

Summarising, we can say wealth advisors play an essential role in our economy. Therefore, everyone needs to be aware of their rights and duties. You should also be able to prevent fraud and other illegal acts.