In 2021, the average financial advisor fee was 1.02% on $1 million in AUM. This article will explain the costs and benefits of robo-advisors as well as how to determine the value of your service. Let's look closer. These are the three most common types advisor fees. Continue reading to find out more. 1.12% is the high cost of $1 million in AUM.

Average fee for financial advisors in 2021 was 1.02% for $1,000,000 AUM

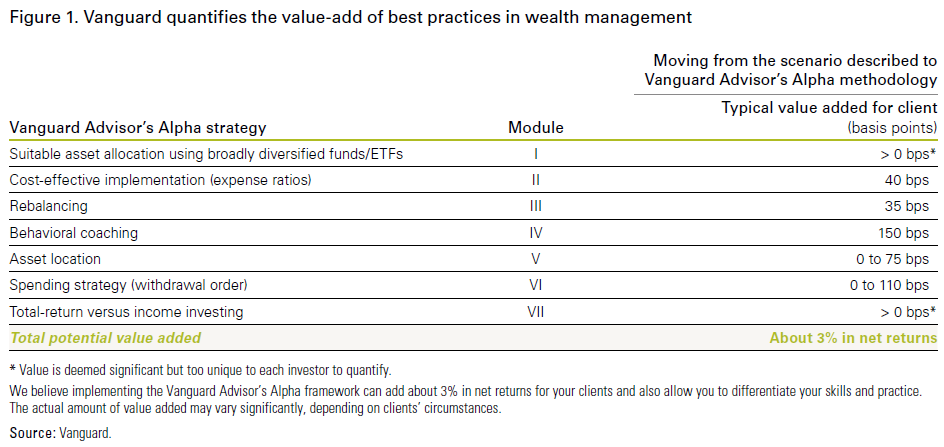

While the percentage-based fee is consistent up to $1 million in AUM, the dollar-based fee is higher. Fee schedules have remained stable in recent years. However rising asset values have led to an increase in income for advisors and not a reduction in compensation. Actually, fees charged to financial advisors based on dollars have increased more than inflation. The following chart shows how fees have changed between 2016-2021.

AUM refers to the account's initial value. Therefore, the average fee will depend on how much you invest. A $1 million AUM account is eligible for a $8,000 fee from a financial advisor. Based on the account's value, advisory fees are typically reassessed annually or monthly. If you've made withdrawals in the past, this means that your fee could be higher one year than the next.

Flat fee financial advisors offer many benefits

Some financial advisors charge a flat fee for their services, but other firms require a percentage of assets under management. The Wealthy Investors Alliance for Comprehensive Planning and Investment Management charges $4,800. Flat fees have several advantages over retainers, which require 8% of assets under management. Flat fees are not suitable for all advisors. They may not accept clients with smaller assets or be more flexible than retainers.

A large fee could discourage you from investing in stocks or saving money for retirement. A flat fee advisor might be something you should consider. AUM advisors charge fees based on the value of your assets. They are motivated to convince you to transfer your account. However, if the flat fee is paid, you will still be able to control your assets.

Cost of roboadvisors

The cost of roboadvisors is usually more than double the traditional fees for financial advisors. This is because an advisor can only work with the information you give them. But, robot-advisors provide more benefits. The biggest benefit is that a robot-advisor costs less than hiring a professional advisor. A robo-advisor can work with you 24/7 without having to call.

Robo-advisors could help investors increase the amount of their investment dollars. Some require a minimum of $200,00 to use their services, while others charge as low as $5k. This makes robo advisors a preferred choice for many investors as they can offer the same services at a lower cost. Also, unlike a financial advisor, a robo-advisor will not charge you for researching stocks or other financial products for you.

FAQ

What are the Different Types of Investments that Can Be Used to Build Wealth?

You have many options for building wealth. Here are some examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its benefits and drawbacks. For example, stocks and bonds are easy to understand and manage. They can fluctuate in price over time and need active management. On the other hand, real estate tends to hold its value better than other assets such as gold and mutual funds.

Finding something that works for your needs is the most important thing. Before you can choose the right type of investment, it is essential to assess your risk tolerance and income needs.

Once you have decided what asset type you want to invest in you can talk to a wealth manager or financial planner about how to make it happen.

What are the most effective strategies to increase wealth?

The most important thing you need to do is to create an environment where you have everything you need to succeed. You don't need to look for the money. If you're not careful you'll end up spending all your time looking for money, instead of building wealth.

Also, you want to avoid falling into debt. Although it can be tempting to borrow cash, it is important to pay off what you owe promptly.

If you don't have enough money to cover your living expenses, you're setting yourself up for failure. When you fail, you'll have nothing left over for retirement.

Before you begin saving money, ensure that you have enough money to support your family.

What Are Some Of The Benefits Of Having A Financial Planner?

A financial plan gives you a clear path to follow. You won't be left guessing as to what's going to happen next.

It provides peace of mind by knowing that there is a plan in case something unexpected happens.

A financial plan will help you better manage your credit cards. You will be able to understand your debts and determine how much you can afford.

A financial plan can also protect your assets against being taken.

Who can I turn to for help in my retirement planning?

For many people, retirement planning is an enormous financial challenge. This is not only about saving money for yourself, but also making sure you have enough money to support your family through your entire life.

When deciding how much you want to save, the most important thing to remember is that there are many ways to calculate this amount depending on your life stage.

If you're married, you should consider any savings that you have together, and make sure you also take care of your personal spending. If you're single, then you may want to think about how much you'd like to spend on yourself each month and use this figure to calculate how much you should put aside.

If you're working and would like to start saving, you might consider setting up a regular contribution into a retirement plan. If you are looking for long-term growth, consider investing in shares or any other investments.

Contact a financial advisor to learn more or consult a wealth manager.

What is retirement planning?

Financial planning includes retirement planning. You can plan your retirement to ensure that you have a comfortable retirement.

Planning for retirement involves considering all options, including saving money, investing in stocks, bonds, life insurance, and tax-advantaged accounts.

How to Choose an Investment Advisor

The process of choosing an investment advisor is similar that selecting a financial planer. There are two main factors you need to think about: experience and fees.

The advisor's experience is the amount of time they have been in the industry.

Fees represent the cost of the service. You should compare these costs against the potential returns.

It is important to find an advisor who can understand your situation and offer a package that fits you.

Statistics

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

External Links

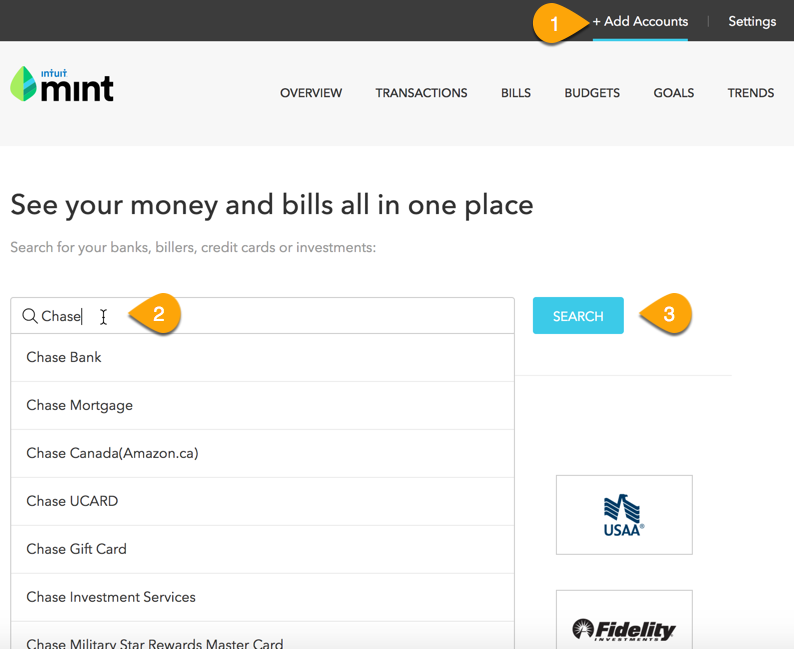

How To

How to become a Wealth Advisor?

You can build your career as a wealth advisor if you are interested in investing and financial services. This career has many possibilities and requires many skills. If you have these qualities, then you can get a job easily. The main task of a wealth adviser is to provide advice to people who invest money and make decisions based on this advice.

The right training course is essential to become a wealth advisor. You should be able to take courses in personal finance, tax law and investments. Once you've completed the course successfully, your license can be applied to become a wealth advisor.

Here are some tips to help you become a wealth adviser:

-

First, let's talk about what a wealth advisor is.

-

You need to know all the laws regarding the securities markets.

-

Learn the basics about accounting and taxes.

-

You should take practice exams after you have completed your education.

-

Final, register on the official website for the state in which you reside.

-

Apply for a Work License

-

Get a business card and show it to clients.

-

Start working!

Wealth advisors typically earn between $40k and $60k per year.

The salary depends on the size of the firm and its location. If you want to increase income, it is important to find the best company based on your skills and experience.

In conclusion, wealth advisors are an important part of our economy. It is important that everyone knows their rights. It is also important to know how they can protect themselves from fraud or other illegal activities.