There are many resources to help you find a financial advisor. One of these is Betterment. You can use the free matching tool to find the best financial advisor for you. Paladin Registry and other resources are also available. A personal recommendation is another great source. The best way to find the right financial advisor for your situation is by getting recommendations from people you trust. Your financial goals will be met by the right advisor.

Paladin Registry

If you're searching for a financial advisor, consider using the Paladin Registry. This online directory of advisors has verified their credentials and includes investor tools. Advisors pay one-time fees to be listed. After paying the one-time fee, advisors can access their contact information. You can also make an appointment for a meeting to interview them. Once you've screened several potential advisors, it's time to choose the one that you want to work with.

Betterment

Although the Betterment Robotic Advisor does not give investment advice, its recommendations will be very similar to those made by a financial professional. The robo-advisor will provide a list of potential investments after an investor answers some questions about their investment goals, risk tolerance, and age. This list will remain the same until the investor changes his or her situation. For example, an older investor will usually invest a higher percentage of assets in bonds and a lesser amount in stocks.

Paladin

Finding a Paladin financial advisor is easy. To use the website you will only need a smartphone and a computer. After you submit your information, the website will send potential advisors to your inbox. You'll then want to interview them to decide if they are right for you. Their contact information will also be sent to you by the website so you can contact them directly. You can also read reviews of each advisor. Remember, advisors listed on Paladin are fiduciaries.

Recommendations from me

It's crucial to select a financial adviser with the right qualifications and experience. An investment advisor that is competent should have a Form ADV with their company. You can also access FINRA's BrokerCheck website to check their background. There are many options to choose an advisor. No matter if you are an individual or a business owner, you will need to seek out a trusted source for advice.

Fee-only

You have many options when it comes to finding a fee only financial advisor. You have two options. One can pay a flat rate for their services or opt for a fee-based option. Fee-only advisers don't get commissions, so you'll be aware of the fees they charge. Fee-only models are more transparent so that you don't have to deal complicated disclosures. Additionally, fee-only financial advisers do not have conflicts of interests.

Fiduciary

Personal referrals are a great way of finding a Fiduciary financial adviser. Although this is a useful method, it's not foolproof. There's no guarantee that a financial adviser will be a Fiduciary. It's difficult to determine whether an advisor is a fiduciary because of the complexity and jargon of the industry. While asking for a personal referral can give you a starting point, it's a good idea to research advisors on your own.

FAQ

What is estate planning?

Estate Planning is the process that prepares for your death by creating an estate planning which includes documents such trusts, powers, wills, health care directives and more. These documents serve to ensure that you retain control of your assets after you pass away.

What is retirement planning?

Retirement planning is an important part of financial planning. It helps you prepare for the future by creating a plan that allows you to live comfortably during retirement.

Retirement planning involves looking at different options available to you, such as saving money for retirement, investing in stocks and bonds, using life insurance, and taking advantage of tax-advantaged accounts.

How to choose an investment advisor

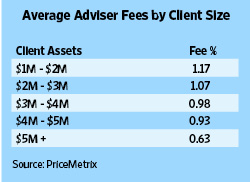

Selecting an investment advisor can be likened to choosing a financial adviser. There are two main factors you need to think about: experience and fees.

An advisor's level of experience refers to how long they have been in this industry.

Fees represent the cost of the service. These costs should be compared to the potential returns.

It's important to find an advisor who understands your situation and offers a package that suits you.

Is it worth employing a wealth management company?

A wealth management company should be able to help you make better investment decisions. You should also be able to get advice on which types of investments would work best for you. You will be armed with all the information you need in order to make an informed choice.

Before you decide to hire a wealth management company, there are several things you need to think about. Consider whether you can trust the person or company that is offering this service. Are they able to react quickly when things go wrong Can they clearly explain what they do?

What are some of the benefits of having a financial planner?

Having a financial plan means you have a road map to follow. You won’t be left guessing about what’s next.

This gives you the peace of mind that you have a plan for dealing with any unexpected circumstances.

A financial plan will help you better manage your credit cards. A good understanding of your debts will help you know how much you owe, and what you can afford.

Your financial plan will help you protect your assets.

Do I need to make a payment for Retirement Planning?

No. These services don't require you to pay anything. We offer FREE consultations so we can show you what's possible, and then you can decide if you'd like to pursue our services.

What age should I begin wealth management?

Wealth Management can be best started when you're young enough not to feel overwhelmed by reality but still able to reap the benefits.

The earlier you start investing, the more you will make in your lifetime.

You may also want to consider starting early if you plan to have children.

Savings can be a burden if you wait until later in your life.

Statistics

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How To Invest Your Savings To Make Money

You can get returns on your capital by investing in stock markets, mutual funds, bonds or real estate. This is called investing. This is called investing. It does not guarantee profits, but it increases your chances of making them. There are many ways to invest your savings. One of these options is buying stocks, Mutual Funds, Gold, Commodities, Real Estate, Bonds, Stocks, ETFs, Gold, Commodities, Real Estate, Bonds, Stocks, Real Estate, Bonds, and ETFs. These methods are described below:

Stock Market

The stock market is one of the most popular ways to invest your savings because it allows you to buy shares of companies whose products and services you would otherwise purchase. Also, buying stocks can provide diversification that helps to protect against financial losses. You can, for instance, sell shares in an oil company to buy shares in one that makes other products.

Mutual Fund

A mutual fund refers to a group of individuals or institutions that invest in securities. They are professionally managed pools of equity, debt, or hybrid securities. A mutual fund's investment objectives are often determined by the board of directors.

Gold

Gold is a valuable asset that can hold its value over time. It is also considered a safe haven for economic uncertainty. Some countries also use it as a currency. Gold prices have seen a significant rise in recent years due to investor demand for inflation protection. The supply/demand fundamentals of gold determine whether the price will rise or fall.

Real Estate

Real estate refers to land and buildings. Real estate is land and buildings that you own. Rent out part of your home to generate additional income. The home could be used as collateral to obtain loans. The home may also be used to obtain tax benefits. But before you buy any type real estate, consider these factors: location, condition, age, condition, etc.

Commodity

Commodities include raw materials like grains, metals, and agricultural commodities. Commodity-related investments will increase in value as these commodities rise in price. Investors who want to capitalize on this trend need to learn how to analyze charts and graphs, identify trends, and determine the best entry point for their portfolios.

Bonds

BONDS can be used to make loans to corporations or governments. A bond is a loan that both parties agree to repay at a specified date. In exchange for interest payments, the principal is paid back. The interest rate drops and bond prices go up, while vice versa. An investor purchases a bond to earn income while the borrower pays back the principal.

Stocks

STOCKS INVOLVE SHARES in a corporation. Shares represent a fractional portion of ownership in a business. Shareholders are those who own 100 shares of XYZ Corp. When the company is profitable, you will also be entitled to dividends. Dividends are cash distributions paid out to shareholders.

ETFs

An Exchange Traded Fund is a security that tracks an indice of stocks, bonds or currencies. ETFs trade just like stocks on public stock exchanges, which is a departure from traditional mutual funds. The iShares Core S&P 500 eTF (NYSEARCA – SPY), for example, tracks the performance Standard & Poor’s 500 Index. This means that if SPY is purchased, your portfolio will reflect the S&P 500 performance.

Venture Capital

Venture capital is private funding that venture capitalists provide to entrepreneurs in order to help them start new companies. Venture capitalists offer financing for startups that have low or no revenues and are at high risk of failing. Venture capitalists usually invest in early-stage companies such as those just beginning to get off the ground.